63+ will increasing my credit limit affect my mortgage application

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

:max_bytes(150000):strip_icc()/close-up-of-credit-application-form-184932708-5b798b7846e0fb00501a015e.jpg)

When To Take A Credit Limit Increase

All you have to do is log into your account online and navigate to the card services page.

. Web An increase in balances credit limit or missed payments could have an impact on the potential mortgage advance. After logging into your account click Account Management followed by Request a Credit Line Increase to file an online application. Web How to increase credit limit with Citi.

Web Increasing your credit limit affects two of the five factors that make up your credit score. So it you go over your 5000 limit to 5010 you can only be. Web The process of how to get a higher credit limit is pretty straightforward and you have three options for pursuing a credit limit increase.

You can ask for a higher credit line by contacting your. Web To find out more you can check your FREE Equifax Credit Report Score which gives you a view of your borrowing history as well as an indication of how creditworthy a lender. Web Your credit limit is the maximum amount of money you can borrow on a credit card.

Ad Compare Best Mortgage Lenders 2023. The lower your ratio is the better. Web Many card issuers make it easy to ask for a credit limit increase.

Web Your credit utilization ratio makes up 30 of your credit score. Web Whether you request a credit limit increase online or over the phone you may receive a response in as little as 30 seconds or you may need to wait up to 30 days. Some lenders may require a line of credit or.

New credit lowers your score. Ad We fill in the gaps that other credit score providers simply dont. There are a few ways to get a higher credit limit.

Web How to request a higher credit limit. When you take out a loan such as a home equity loan it shows up as a new credit account on your credit report. It is normally determined by the lender who uses your credit report and information on your.

Web By waiting to apply for a credit card until after your mortgage loan is finalized you can ensure that this new application line of credit and hard inquiry wont. Take out the guesswork with credit. You can request a credit.

Dont Settle Save By Choosing The Lowest Rate. Mortgages typically require 15 to 30 years of payments which is plenty of time to polish your score. Web If that worst case scenario became reality and your monthly payments -- including your mortgage payment -- total more than 36 percent of your monthly income youre unlikely.

Web Raising your credit limit will reduce the percentage of funds being used lower the credit utilization ratio and should improve your credit score as long as you. Pinpoint whats most affecting your scores. Web If you add a new card with a 5000 limit and a zero balance your credit utilization drops to around 15good news since amounts owed on your accounts make up 30 of your.

For example if youve spent 500 on a credit card with a limit. Apply Online Get Pre-Approved Today. Web When you increase your credit limit you may also be improving your credit utilization ratio which can help your credit score in the long run.

Credit scores reflect your amount of debt relative to your. How Balances and Credit Limits Affect Credit. Lock Rates For 90 Days While You Research.

Web However increasing your credit limits on your credit cards will not likely hurt and can help your credit scores in the long run. Web But another provision of the law is that the over limit fee cant be greater than the amount youve gone over. Web Nothing affects credit score more than your payment history.

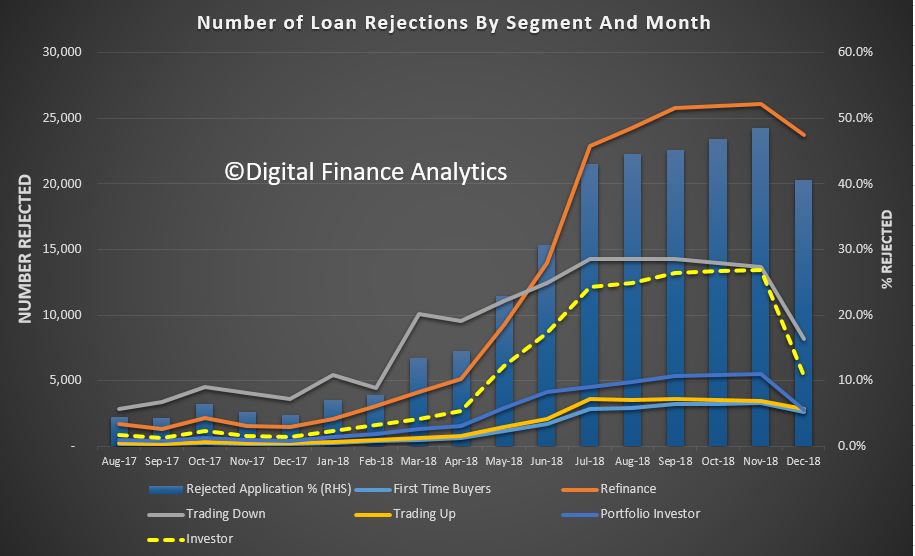

Why Mortgage Applications Get Rejected What To Do Next

:max_bytes(150000):strip_icc()/AnAmericanExpresscard-5b493defc9e77c0037bf0d8f.jpg)

When To Take A Credit Limit Increase

How To Increase Your Credit Limit Creditcards Com

:max_bytes(150000):strip_icc()/online-shopping-1057492944-5c6c2049c9e77c0001476503.jpg)

When To Take A Credit Limit Increase

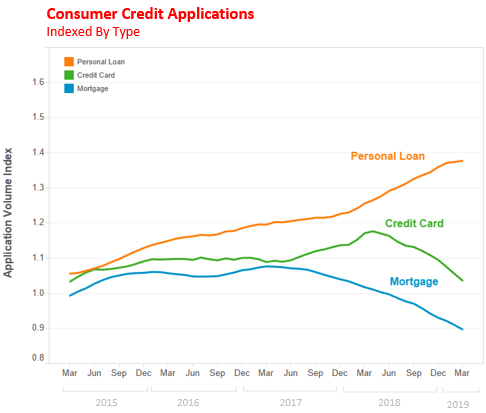

What Impact Do Changing Interest Rates Have On Mortgage Demand Joint Center For Housing Studies

Jrfm Free Full Text Communication As A Part Of Identity Of Sustainable Subjects In Fashion

Core Questions Economic And Social Data Service Esds

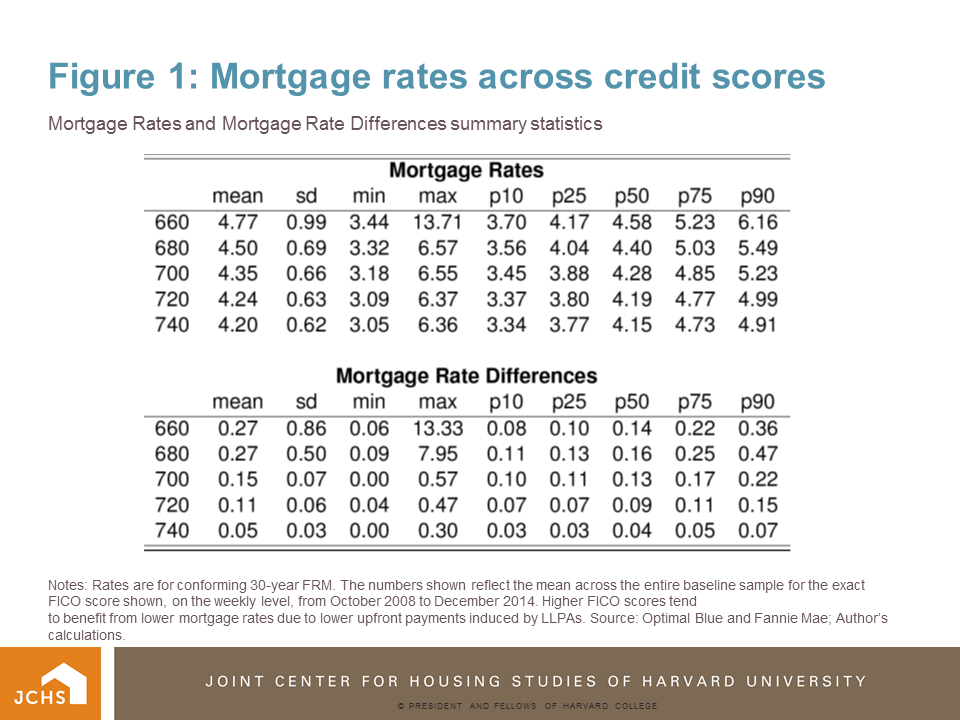

High Risk Mortgages Bring Higher Interest Rates

Business Succession Planning And Exit Strategies For The Closely Held

6 Key Factors That Influence Your Apr Bestcompany Com

12 Home Loan Rejection Reasons Savings Com Au

How Applying For A Mortgage Will Affect Your Credit Score

Lisa Melton Baxter Swbc Mortgage Blairsville Ga Facebook

Why Mortgage Applications Get Rejected What To Do Next

6 Benefits Of Increasing Your Credit Limit

Seven Factors That Determine Your Mortgage Interest Rate Consumer Financial Protection Bureau

E Edition Register Star May 25 2021 By Columbia Greene Media Issuu